Chapter 3: Tips for Diversifying Your Retirement Portfolio With Gold

If you’re looking to enhance your investment portfolio, you’ve likely found that the advice about what to do runs the gamut from risky to conservative.

Yet, among much of the advice, diversification is often touted as a tried and true way to help manage risk and reach long-term financial goals.

Investors can diversify by investing in a variety of assets and markets, including stocks and bonds, mutual funds and ETFs, and even in precious metals, like gold.

If you’ve ever read mainstream financial advice, you’ll notice that gold is not often mentioned as an investment asset. At best, you might find some advisers who recommend holding 4-5% of a portfolio in gold, or more likely in a gold ETF or gold index fund. While many advisers may look down on gold, that could mean missing out on the many advantages that investing in it can bring.

As you work towards building a well-diversified investment portfolio, make sure you know all your options, especially when it comes to gold, whether it’s with a gold IRA, a gold IRA rollover , or gold coins and bars, we’re here to clear up any mystery around the benefits of investing in gold.

What Is Diversification and Why it Matters to Investors

Diversification is a strategic way of managing your investment portfolio to include various types of investments to reach specific financial goals over the long term. A well-diversified investment portfolio can offer you the potential for improving returns without subjecting yourself to high-risk investments that are limited in focus.

Loading up on one stock or one industry could be costly if that stock or industry suddenly plummets. Likewise, reacting suddenly when the market changes can lead to knee-jerk investment decisions that don’t benefit you in the long term.

A diversified retirement portfolio can’t promise huge gains or prevent losses, but it is a strategy that some personal investors, financial planners, and fund managers use to create balance–and one such way to effectively diversify can be by investing in gold.

The Precious Metals Strategic Edge: Protection and Diversification

If you’re like many investors, you probably dream of a safe and comfortable retirement. It’s why you’ve worked hard, saved, and invested for so many years. But you probably also know that your retirement savings could disappear in an instant in the event of a stock market crash or a severe recession.

You don’t want to leave your investment portfolio at the mercy of financial markets that can severely cut your savings, which is why taking control of your future by investing in a gold IRA can be a good option for a diversified investment portfolio. Investing in physical gold through a gold IRA can give you:

- Stability: Gold has consistently grown in value over time

- Security: The gold that is used to back a gold IRA is securely stored, fully insured

- Simplicity: Understanding the value of gold doesn’t require special training, and you can easily check daily gold prices on your own

Additionally, gold IRAs offer specific benefits that can be superior to those of other types of investment assets. These include:

- Wealth protection: Gold maintains its value whereas the US dollar fluctuates with inflation and currency devaluation

- Tax advantages: Use pre-tax dollars to invest in gold, accrue tax-free gains, and only pay taxes upon distribution, just like a conventional IRA. Even better, you can learn how to diversify your 401(k) or IRA by rolling over existing assets to a gold IRA.

- Long-term financial assurance: Investing in gold is a great long-term choice because it has outperformed cash, stocks, and bonds over the last 50 years

- Financial control: Diversifying your assets with a gold IRA puts you in control of your wealth.

How Does Investing in Gold and Precious Metals Work?

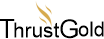

There are a number of ways to invest in gold and other precious metals depending on your financial situation and goals. The following sections and Qualified Rollover and Transfer Chart will help you better understand how to create a diversified retirement portfolio with gold.

How to Diversify 401(k) With a Gold IRA Rollover

The 1974 passage of the Employee Retirement Income Security Act (ERISA) allowed for the formation of IRAs so working Americans who did not have a traditional form of employment could more easily leverage tax-deferred benefits of retirement accounts.

For years, investors with 401(k)s and IRAs who wanted to save for retirement could only build their portfolio with stocks, bonds, or other paper currency–backed assets.

Now, anyone can open IRAs to leverage the tax benefits that traditional retirement accounts offer, including self-directed IRAs. These types of IRAs give you full control over investments because you don’t have to choose from a select few funds offered by your employer or your broker.

A self-directed IRA allows you to invest in real estate, private bonds, private equity, precious metals, and more. Many people choose to do a 401(k) rollover, which allows them to transfer funds to an IRA account without tax consequences. When the stock market experiences volatility, many future retirees look to a gold IRA rollover to diversify retirement investments.

The benefits of a gold IRA rollover include:

- Defense against currency devaluations

- Protects against effects of inflation

- Makes retirement funds less susceptible to government seizure

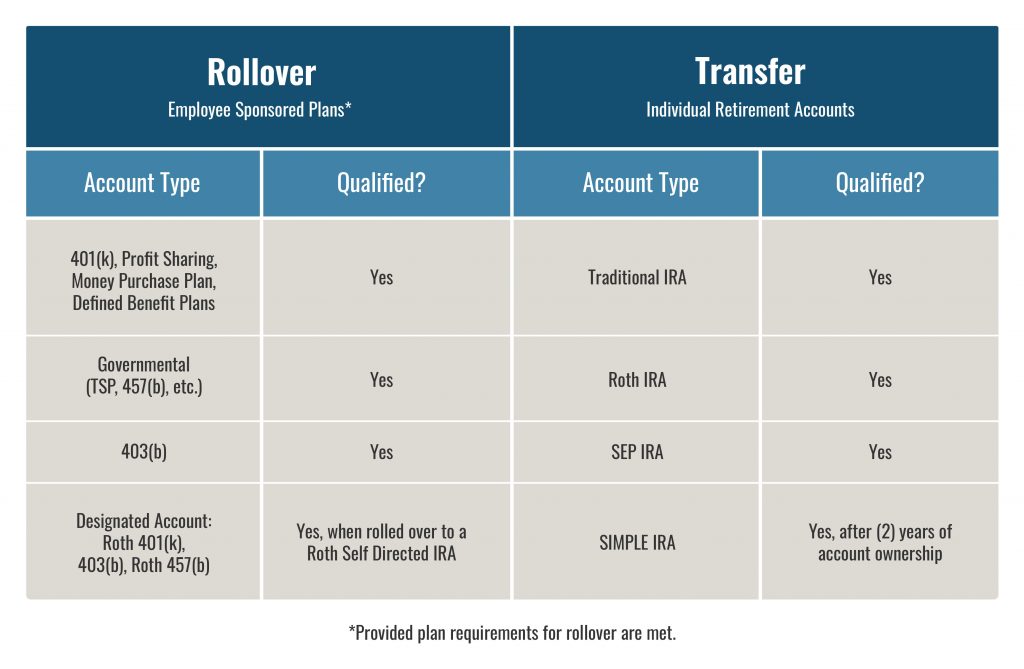

4 Steps to a Gold IRA Rollover for Diversifying a 401(k):

- Learn about various investment options, as well as more information about investing in gold and other precious metals from a precious metals expert.

- Fill out the necessary forms to open your account.

- A precious metals investment expert will assist you in transferring a portion of your retirement account funds into a self-directed IRA.

- Choose which metals you want to purchase, after which they will be sent to a highly secure storage facility.

Diversified Investment Portfolio With Gold IRA Coins

In addition to a gold IRA rollover, investors can allocate part of their portfolio to investing in gold coins or gold bullion.

It’s important to note that while collectible coins will appeal to some investors, they are not eligible to be placed in IRAs. Any gold that’s placed in an IRA has to meet certain guidelines that are spelled out in the Internal Revenue Code. You also can’t place gold that you already have into a gold IRA. The following guidelines apply to eligible gold for an IRA:

- Qualified gold must have a fineness of .995, or 99.5% purity, except for a few coins minted by the US Mint and specifically exempted.

- Must be held by your IRA custodian. Home storage is generally not possible, as the risk of tax penalties is high and the regulatory hurdles are outside the abilities of all but the most wealthy investors.

- Check IRA Contribution Limitsbefore investing in gold coins

- You cannot add currently owned gold to your IRA but you can open a gold IRA and purchase new gold to add.

Diversifying your retirement portfolio with gold may be a great way to secure investments, but you should remember that physical gold is intended more for long-term wealth protection and maintenance rather than short-term gains.

Connecting with a qualified gold coin and precious metals expert can ensure that you make your gold investment wisely.

Are Gold ETFs a Good Way to Diversify an Investment Portfolio?

Some investors have turned to popular gold exchange-traded funds (ETFs). ETFs offer you the ability to invest in a number of different assets, some of which you may otherwise have difficulty investing in. This has been seen as a potential way to diversify an investment portfolio, since ETFs open up the range of investment options to allow ordinary investors to enter new markets.

Unfortunately, there are several drawbacks to gold ETFs that can make them a less than ideal choice if you’re considering investing in gold:

- You don’t own the gold in a gold ETF: You actually only own the shares in a fund, which owns a certain quantity of gold. Share prices can fluctuate drastically depending on the price of gold and whether investors decide to liquidate their shares.

- You can’t take physical delivery of gold: The exception to this rule is if you own millions of dollars’ worth of shares, but it’s still important to look at the fund’s contract before investing.

- Custodians may be unknown: Custodians for gold ETFs can also contract with sub-custodians, which makes it hard to track who is holding the gold.

- Taxes and fees: Fees associated with fund managers, listing on exchange, and custodians can add up and may trigger certain tax consequences.

- Shares may or may not have appropriate gold backing: Funds may sell gold to meet expenses, which means shares may not be backed by as much gold as you thought.

Let ThrustGold Help You Diversify Your Retirement Portfolio

Diversifying your investment portfolio can be a great way to protect your valuable retirement savings from market fluctuation and the ever-changing global economic environment. You may have many different ideas for diversification, but when it comes to investing in gold as a part of your strategy, the experts at ThrustGold are the best source for helping you do so with success.

Whether you want to learn about how to diversify your IRA, start a gold IRA transfer or 401(k) rollover, or invest in gold coins, we’re here to help you protect your hard-earned retirement savings and create a well-diversified portfolio, no matter what your age.

Read Chapter 4 to learn more about how to rollover your 401(k) into a gold IRA.

Beginner’s Guide

to a Gold IRA

Table of Contents

Chapter 1: Beginner’s Guide to a Gold IRA: Is a Gold IRA a Smart Investment Choice?

Chapter 2: Gold IRA Rules to Know Before Investing

Chapter 3: Tips for Diversifying Your Retirement Portfolio With Gold

Chapter 4: How to Move Your 401(k) to Gold Without Penalty

Chapter 5: How a Self-Directed Gold IRA Works

Chapter 6: Diversifying Your Portfolio: How to Start a Precious Metals IRA

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.