Chapter 1: Beginner’s Guide to a Gold IRA: Is a Gold IRA a Smart Investment Choice?

If you are an investor, there are many financial questions to ask yourself. You want your retirement portfolio to perform well and make money but in the back of your mind, you understand that your portfolio can be subject to huge losses. That’s why many of the most successful investors are those who protect their portfolios from major losses, not necessarily those who make the biggest gains.

A time-honored way to protect your investments and retirement portfolio is by investing in gold. Investors have sought the safety and security of gold for centuries, and today is no different. When stock markets crash, or when there’s even a hint of a crash, investors race to get their hands on as much gold as they can. Even outside times of financial difficulty, investing in gold is a smart and proven method of portfolio diversification.

One way to take precious metal investments further is with gold IRA investing, like a gold 401(k) rollover. With the same great advantages of conventional IRAs, investors can solidify their retirement with more stable assets, safe from volatile financial markets.

Given the long-term stability of gold and silver, they make perfect assets for investors looking to diversify their investments. If you’re looking to protect your retirement savings, ensure that you have enough to live comfortably in retirement, and pass money on to your heirs, keep reading our beginner’s guide to a gold IRA to find out more about the numerous advantages of a gold-backed IRA.

What Is a Gold IRA?

A gold-backed IRA allows investors to invest in gold and other precious metals while still enjoying the same tax advantages of an IRA retirement account. Just like conventional IRAs, a gold IRA can be a traditional IRA in which investors use pre-tax dollars to invest in gold, or a Roth IRA in which they use post-tax dollars to invest in gold. Those with SEP or SIMPLE IRAs can also invest through a gold IRA.

Investors can also roll over existing retirement assets into a gold IRA. This allows investors to lock in gains they may have made in stocks and transfer that wealth into precious metals, which can provide more stability.

The history of IRAs extends back to the 1974 Employment Retirement Income Security Act (ERISA), which allowed individuals to establish individual retirement accounts or IRAs.

Prior to ERISA, it was tough to have a tax-advantaged retirement account outside of an employer-run retirement plan. Following the passage of ERISA, individuals could create IRAs, which eventually led to the development of Self-Directed Individual Retirement Accounts. Self-directed IRAs allow individuals to direct retirement funds to invest in non-traditional investments such as real estate, bonds, private companies, and precious metals.

Gold is a tangible asset that anyone can own and hold, and it offers stability against inflation, financial turmoil, and economic downturns. Thanks to loopholes in the tax code, investors can even invest in gold through a gold IRA, allowing them to gain all the same tax benefits as a conventional IRA.

Advantages of a Gold-Backed IRA

Gold IRAs have numerous advantages for investors, both those nearing retirement and those earlier in their careers. Two of the foremost advantages are:

- Providing much-needed diversification to investors’ portfolios in both the short- and long-term.

- Helping investors with risk adjustment: The further they get in their retirement planning, the less risky they want their portfolio to be.

To do this, investors can decrease the percentage of stocks or bonds they hold and increase the amount of gold they own.

This doesn’t mean that you have to pour all of your assets into a gold-backed IRA, but even small percentages can be incredibly beneficial.

Investors who put gold into their portfolios during the 2008 financial crisis saw their investments strongly outperform those who kept their assets in stocks. And those portfolios that held gold continued to grow stronger after the crisis hit its lowest point, in many cases for years afterward.

Let’s take a more detailed look at the benefits of gold IRA investing:

1. Diversification Beyond Stocks and Bonds

A strong investment portfolio is one that is properly diversified. Diversification doesn’t just mean having a mix of stocks and bonds, which is what most financial advisers are most familiar with. It means diversifying your assets so that you’re not concentrating your risk in any one area, whether it’s a single country, currency, or industry.

Traditional retirement accounts that offer a mix of stocks, bonds, money market funds, etc., are all at the mercy of Wall Street. If financial markets seize up, if bond markets become illiquid, if stock markets crash, all of those assets can perform poorly.

One advantage of investing in physical gold is that it helps investors diversify and shift risk away from financial assets, leaving a portion of their portfolio protected during those times when the stock market experiences weakness. In fact, as the stock market weakens, gold often performs better, making it an ideal asset to protect a portfolio when a recession is on the horizon.

2. Insurance Against Stock Market Fluctuations

Physical gold acts as a hedge against dips in more volatile markets. The boom and bust of the business cycle is all but a certainty, with stock market crashes and recessions occurring with unfortunate regularity.

Gold has always acted as a hedge and will continue to do so in the future. Unlike paper assets like stocks and bonds that can become worthless as companies fail, gold will always be worth something.

An ounce of gold will always be an ounce of gold, will always be in demand around the world, and will continue to maintain its value over the long term no matter how poorly the economy performs.

3. Control Over Investments

Investing in a gold IRA also provides investors with a greater element of control over their investments. For many investors who may save for retirement through a 401(k) plan, the options available to them are limited.

By opening a gold IRA, they gain an extra element of control over their investment portfolio, as they are the ones who determine what types of gold or silver they invest in.

A great advantage of having a gold IRA is that assets can be transferred easily and without tax consequences among retirement accounts. So, an investor who wants to roll over a portion of a 401(k) account into a gold IRA can do so relatively easily. And if that investor decides in the future to sell some of those precious metals assets to buy into stocks or bonds, that type of transaction can be done too.

Control over investments can:

- Help diversify your investment portfolio

- Deliver peace of mind

- Ensure that decisions you make will directly impact your retirement

4. Positive Growth Potential

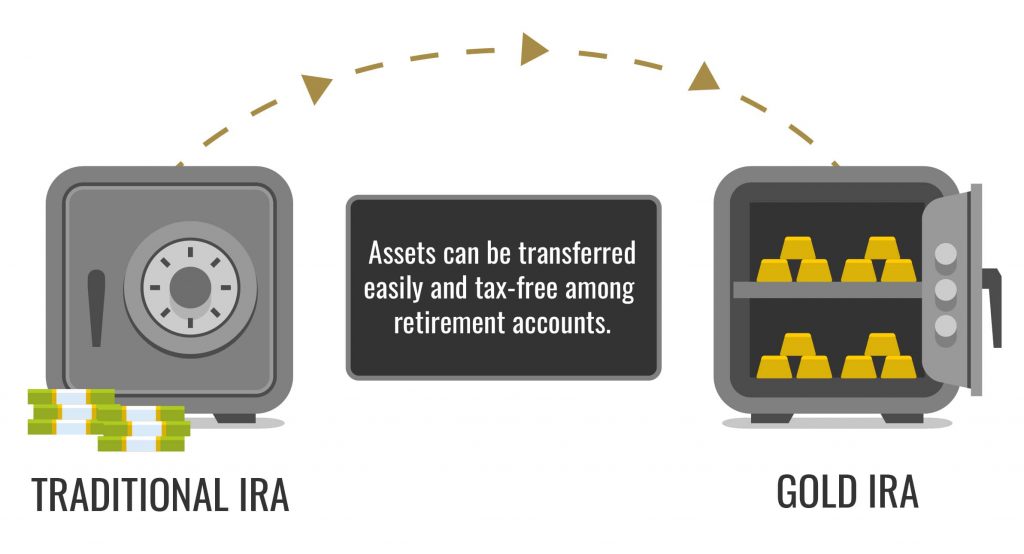

There’s a dirty little secret that mainstream financial advisors don’t want you to know about: Gold is the second-best performing asset of the past 20 years. In fact, it’s grown about twice as fast as stock markets have. But advisers still recommend stocks for asset growth for two reasons:

- They’re still stuck feeling nostalgic about the 1982-2000 stock market boom. That was a period of unprecedented growth, with stock markets growing around 17% per year on average. But we haven’t seen growth like that since then, and we may never see growth like that again.

- Most financial advisors make their money off fees associated with stock trades, asset management, etc. They don’t make money selling people gold because people hold gold for the long term. Financial advisors and stockbrokers want to be able to charge for each trade, plus a small management fee every year for each type of asset you own. But if you own gold for years and years, they can’t charge you trading fees because your assets are safe, secure, and not moving.

While bad for financial advisors, it’s good for you because your gains aren’t being nickeled and dimed to death through fees. Traditional advisory fees are death by a thousand cuts, but investing in gold ends that and keeps more money in your pocket.

Some advisors may try to lure investors into annuities, promising guaranteed income for years. What they often downplay is the fact that your money is tied up for years, and you could pay hefty penalties to get it back.

It also means that you could miss out on great gains if markets are doing well. With a gold IRA, you can benefit from gold’s stability, take advantage of future price growth which can sometimes be substantial, and still have immediate access to your money should you wish to sell your gold or transfer your wealth into other assets.

5. Tax Advantages Like a Conventional IRA

Investing in a gold-backed IRA offers the same tax advantages as a conventional IRA. You can invest in gold with pre-tax dollars (or post-tax dollars with a Roth gold IRA), roll over existing retirement assets with no tax consequences, and defer taxation until you decide to take a distribution. And just like with contributions to a traditional IRA, annual contributions to a traditional gold IRA can even be tax-deductible.

That also means that all the same IRA rules apply to a gold IRA:

- Early distributions may incur income taxes and an additional 10% penalty

- Required minimum distributions must be taken after age 72

- Annual contributions are limited to $6,000 (or $7,000 if you’re over age 50)

But when you take a distribution, you can choose to take it either in cash or in physical gold.

By keeping gold in an IRA, many investors feel like they get a much better rate of return than when they hold precious metals through a traditional brokerage account, such as those offered by some mints. Don’t underestimate the ability to use pre-tax dollars and defer taxation on your gains for years or even decades.

Beginner’s Guide to a Gold IRA: How to Get Started

Transferring existing retirement assets into a gold-backed IRA is a simple process. You don’t even need to make another initial deposit to get started.

One of the first things to do is find a trusted partner that can offer the best in precious metals investing. Check that they have a positive rating from Consumer Rating Agencies to ensure that they offer you ethical, dependable solutions.

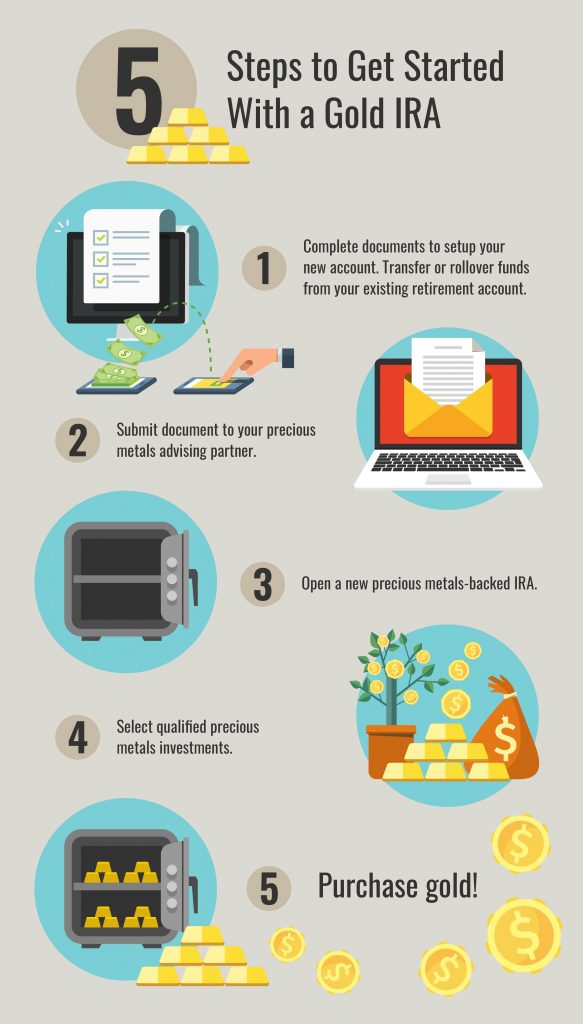

After you’ve found a qualified precious metals provider, you’ll go through the following basic steps to get your gold IRA started:

- Complete documents to set up a new gold IRA account, and transfer or roll over the funds from your existing IRA, 401(k), or other retirement account. You may also opt to contribute funds according to annual IRA limits, thus opening a new IRA.

- Submit documents to your precious metals advising partner

- Open a new gold-backed IRA

- Select qualified precious metal investments

- Purchase and pay for gold

IRA Standards for Precious Metals IRA

Before choosing your precious metals investments, such as gold IRA-approved coins, it’s important to check that they meet IRA eligibility standards and guidelines. Purchasing precious metals that aren’t eligible for IRA investment may be considered a distribution of IRA assets, which could leave you subject to taxes and penalties. Some general guidelines for precious metals IRA assets include:

- Level of Purity

Gold – .995

Silver – .999

Platinum – .9995

Palladium – .9995

- Place of issue – some US Mint coins are automatically eligible for IRA investment even though they don’t meet the normal purity standards.

- Held in custody of an IRS-registered custodian until retirement age. At 59 ½ years of age, you can begin taking distributions in the form of physical precious metals or by selling your metals for cash.

Your Guide to Investing in Gold

Regardless of your age, there are many questions about investing–and ThrustGold is here to help. From learning about daily gold prices to gold IRA/401(k) transfers and rollovers, we can help you navigate the world of precious metals investing with ease and success.

We believe that gold IRAs are the best way to diversify and protect your investment portfolio. With both tremendous potential for growth as well as the ability to safeguard your existing wealth, precious metals are unmatched as physical investment assets.

If you’re worried about how best to protect your life savings or have questions about how to start your own gold IRA, contact us.

Continue reading Chapter 2 to learn more about the latest IRA rules and regulations that may impact your decision to invest in gold.

Beginner’s Guide

to a Gold IRA

Table of Contents

Chapter 1: Beginner’s Guide to a Gold IRA: Is a Gold IRA a Smart Investment Choice?

Chapter 2: Gold IRA Rules to Know Before Investing

Chapter 3: Tips for Diversifying Your Retirement Portfolio With Gold

Chapter 4: How to Move Your 401(k) to Gold Without Penalty

Chapter 5: How a Self-Directed Gold IRA Works

Chapter 6: Diversifying Your Portfolio: How to Start a Precious Metals IRA

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.