Chapter 5: How a Self-Directed Gold IRA Works

One of the main questions people ask when saving for retirement is how to maximize their investment growth. For many investors, relying on stocks, bonds, mutual funds, and CDs has been their go-to investment source, particularly through a 401(k) or IRA.

These traditional assets may not offer as much diversity or long-term security, which is where a self-directed IRA can be useful.

Investing in a variety of assets allows investors to hedge their losses, maintain their gains during tough economic times, and keep their assets secure during market volatility. Thankfully, you don’t have to be rich or at retirement age to start taking advantage of alternative investments.

To help you get started with gold IRA investing, we’re offering our useful guide on everything you need to know about self-directed gold IRAs, including what they are, advantages, and how to start your very own.

What Is a Self-Directed Gold IRA?

Before we address gold IRA investing, it is important to understand the basics of a self-directed IRA.

A self-directed IRA (SDIRA) allows you to invest in alternative assets that aren’t found in most Traditional IRAs. Self-directed IRAs require the use of a custodian or trustee who administers the account, but you (the account holder) actually get to manage the account directly. Alternative investments allowed in a self-directed IRA include:

- Real estate

- Promissory notes

- Gold, silver, and other precious metals

- Cryptocurrency

- Mineral rights, water rights, and oil and gas

A gold IRA is simply a type of self-directed IRA that focuses on investing in precious metals such as gold coins and bullion (bars and ingots).

What Are the Advantages of a Gold IRA?

Gold IRAs can offer many advantages to investors, whether nearing retirement, or earlier in their careers. Investors do not need to pour all their assets into a gold IRA, but simply moving small percentages of investments into precious metals can reap long-term benefits. A few advantages of self-directed gold IRAs include:

- Mitigate investment risks

- Diversify investment portfolio

- Weather market fluctuations

- Receive tax advantages like those for Traditional IRAs

Some investors may wonder if a 401(k)or self-directed IRA is a better investment. Very often they wonder this after they’ve left an employer and still have 401(k) assets held in their old retirement plan. If you leave your employer, you have the option to roll over your retirement savings into an IRA, which may be a good opportunity to explore a self-directed gold IRA, which offers investment diversity and assets that are more stable through economic downturns.

What Is IRA-Eligible Gold?

A gold IRA is a type of self-directed IRA that allows investors to invest in precious metals, like gold or silver. But what does IRA-eligible gold mean? Gold and other precious metals need to meet specific IRS standards according to Section 408(m)(3) of the Internal Revenue Code. These standards address gold coins and bars and set their level of fineness and purity, in addition to other contribution and storage rules. These rules include:

- The gold must have a fineness of .995, or 99.5% purity.

- Gold has to be held by a custodian.

- Standard IRA contribution limits apply.

- Gold you already own cannot be added to a gold IRA, but you can open a gold IRA and purchase new gold to add.

What Is a Self-Directed IRA Custodian?

Your self-directed gold IRA needs to have a custodian per IRS regulations who is responsible for keeping your investments safe and ensuring that all IRS and government regulations are followed to avoid penalties.

Custodians for Traditional IRAs are typically banks, insurance companies, brokerage firms, or mutual fund companies. While these can also service a self-directed IRA, it may be more useful to find a qualified self-directed IRA custodian who specializes in precious metals investing.

Choosing a custodian with knowledge of self-directed gold IRAs will help you make decisions about what types of precious metals to invest in so that they are IRS-approved, particularly if you are trying to do a gold 401(k) rollover. Choosing just any custodian could result in severe penalties that greatly affect your valuable investments.

What Are IRA Rules and Regulations for Self-Directed Gold IRAs?

In addition to the rules governing the types of precious metals allowed in a self-directed IRA, there are general regulations that apply to IRAs, which include required minimum distributions (RMD), contribution limits, and withdrawals.

It is important to note recent changes that may affect these regulations as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES):

- Required minimum distributions (RMDs) are waived for 2020 and include inherited IRAs and traditional IRAs, 401(k)s, and 403(b)s for people over age 72.

- Take an early withdrawal up to $100,000 without paying 10 percent penalty, if you are a “qualified individual”: you, a spouse, or dependent are diagnosed with COVID-19, you experience financial difficulties due to job loss, furlough, reduction in hours, or lack of childcare.

- Limits on how much can be borrowed from employer retirement plans are increased for “qualified individuals”

What Are IRA Contribution Limits?

The IRS sets contribution limits on IRAs, which must be followed in order to avoid penalties. This is important if you’re looking at how to move 401(k) to gold without penalty , or make any other types of contributions.

The following guidelines will help you understand contribution limits for gold IRAs:

- Limited to $6,000 in contributions per year ($7,000 if you’re over age 50).

- Contributions are across all IRAs, so if you have multiple IRA accounts, you are limited to that $6,000 total across all your accounts.

- Contributions are per person, not per account–potential to contribute to multiple IRAs in the same year.

- If you are over 50 years old, you are allowed to make additional contributions to a 401(k). The catch-up contribution limit for 2020 is $6,500.

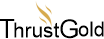

How to Place Physical Gold in an IRA

1. Choose the Type of Self-Directed IRA

The type of self-directed gold IRA you set up will be dependent on how you want to fund your IRA. Most investors will choose to open a Traditional gold IRA, so that they can invest with pre-tax dollars or roll over funds from existing retirement accounts. Investors transferring or rolling over funds from a Roth account will need to choose a Roth gold IRA. You can also open a Roth gold IRA if you want to do a Roth conversion.

2. Decide on a Funding Source

When funding your gold IRA, you can use cash or roll over funds from a 401(k), 403(b), 457(b), or TSP plan. You also have the option of transferring funds from a Traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA.

Be sure to check with your tax advisor before making any changes to see if there are tax implications and confirm that your current retirement accounts allow transfers or rollovers.

3. Choose a Qualified Self-Directed Gold IRA Custodian

Gold IRA assets need to be stored with a custodian per IRS regulations. Working with precious metals investing experts, like those at ThrustGold, will help you find a custodian experienced with gold IRA investing to make sure your investments are made properly.

4. Fund Your Self-Directed Gold IRA

If you’re rolling over, you’ll sell assets in your current retirement accounts and roll them over into your gold IRA. It’s very important to work with gold IRA specialists to make sure that the rollover process adheres to all IRS regulations. If done incorrectly, there may be tax liabilities. After funds are rolled over, you can begin investing in gold.

5. Select Your Metals

Now that your self-directed gold IRA is funded, it’s time to choose which gold coins or bars you want to invest in. Remember to check if your gold is eligible based on the IRS Codes. Collectibles like coins, stamps, antiques, and artwork are not eligible, with some exceptions for gold IRA coins.

Choose gold dealers that have at least 5 years of industry experience to avoid counterfeit products. Every mint keeps records of the coins they produce, which will help prevent you from purchasing a counterfeit product.

Safeguard Your Retirement with Precious Metals

By setting up a self-directed gold IRA, you can rest easy knowing your assets are safe and secure from stock market fluctuations, inflation, or defaulting bonds.

There’s no better time than today to invest in gold. With the economy being up in the air and stock market fluctuations in full swing, a gold IRA may be just the solution to protecting your investments. And setting up a self-directed gold IRA is easy, especially with the help of ThrustGold’s experts. Check daily gold prices, ask questions, and learn about investing in gold to protect your portfolio, all with ThrustGold!

Beginner’s Guide

to a Gold IRA

Table of Contents

Chapter 1: Beginner’s Guide to a Gold IRA: Is a Gold IRA a Smart Investment Choice?

Chapter 2: Gold IRA Rules to Know Before Investing

Chapter 3: Tips for Diversifying Your Retirement Portfolio With Gold

Chapter 4: How to Move Your 401(k) to Gold Without Penalty

Chapter 5: How a Self-Directed Gold IRA Works

Chapter 6: Diversifying Your Portfolio: How to Start a Precious Metals IRA

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.