Chapter 4: How to Move Your 401(k) to Gold Without Penalty

As you age, you may start looking into the many ways in which you can put money aside for retirement. If you have a401(k) from an employer that is sitting idle, rolling over all or part of your 401(k) into a gold IRA may be a good option for attaining your financial goals.

To do that, you need to start by setting up a self-directed gold IRA. Moving your retirement funds into a self-directed IRA gives you the potential for more investment options like real estate, private bonds, private equity, and precious metals like gold and silver.

Investing in precious metals is a popular option because they have been used as a time-tested means of storing wealth that can weather numerous economic changes, giving your portfolio diversity and stability. The price of precious metals often increases even in tough economic times, meaning that your portfolio has extra insurance against the woes of a financial crisis.

Like any 401(k) and other retirement plans, there are rules and regulations to be aware of. The last thing you want to do is decide to roll over your 401(k) and be hit with penalties because you didn’t do things correctly.

So, how do you move your 401(k) to gold without penalty? This guide will help you understand what a 401(k) is, how it works, its benefits, and how to effectively roll over your 401(k) to gold without incurring penalties.

What Is a 401(k) Plan?

Section 401(k) of the Internal Revenue Code allows individuals to make contributions to a retirement account in a tax-deferred manner. This means that they will not be taxed on that contribution until they take a distribution when they retire (at age 59 1/2 or later). The following guidelines about 401(k)s are set forth by the IRS:

- Elective salary deferrals are excluded from the employee’s taxable income (except for designated Roth deferrals).

- Employers can contribute to employees’ accounts through matching.

- Distributions, including earnings, are includible in taxable income at retirement (except for qualified distributions of designated Roth accounts).

Employer matching is a valuable way for individuals to save additional money for retirement if an employer offers that plan, and some even refer to it as “free money.”

If you are contributing to a 401(k) fund, remember that the company managing the fund takes fees from your 401(k) even when you aren’t contributing. Over time, those fees can add up to a significant amount if you’re not continually contributing money. One way to help avoid those fees is through a 401(k) rollover, which transfers assets to an IRA to broaden your investment choices.

Like IRAs, 401(k)s are subject to required minimum distributions (RMDs), which require investors aged 72 and older to take a specific amount in distributions each year. Due to the global COVID-19 pandemic, the US Congress passed the CARES Act, which waives RMDs for the remainder of 2020. Yet, it’s still important to know how to take RMDs to avoid penalties in the future, which we’ll discuss throughout this guide for how to move a 401(k) to gold without penalty.

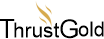

What Are the Benefits of a 401(k) Plan?

There are many more benefits to a 401(k) plan that include:

- Allowing employees to save money easier by automatically withdrawing from their paychecks into their retirement accounts.

- Employer matching contributions to help employees build their nest egg for retirement.

- Tax-deferred contributions, meaning that the money they contribute to their 401(k) will not be taxed. If you are making $45,000 a year and you contribute $5,000, you will be taxed on $40,000 of rather than the full $45,000, meaning you pay lower taxes on your income. You will, however, need to pay the taxes when you take the withdrawal in retirement.

- Potential for borrowing from your 401(k) to pay for: unforeseen medical emergencies, burial or funeral expenses for the family, education, purchase of a principal residence, to prevent eviction, and to repair damage to your principal residence after certain casualty losses. While this is an option, it may cause distributions to lose any market gains.

To add to these benefits, you can consider a gold IRA rollover. Knowing how to roll over your 401(k) into a gold IRA means keeping all the great benefits of a tax-advantaged retirement account, plus the peace of mind of knowing that your investments can be secured in precious metals.

What Is a Gold IRA Rollover?

A rollover IRA is a term for an individual retirement account (IRA) that is funded by moving funds from a 401(k), 403(b), TSP, or similar retirement account into an IRA. The main difference between a 401(k) and an IRA is that an IRA is normally opened by the individual rather than being offered by an employer.

With a rollover IRA, investors can use existing retirement funds to take advantage of a broader range of investments than are available through 401(k) investments alone. And by investing in a self-directed IRA, you have even more options for investments, such as a gold IRA rollover.

Rollover IRAs are most often created when changing jobs or retiring, as they allow employees to move their current 401(k) or other retirement account balances into an IRA account that will offer a better array of investments and superior performance.

When performing an IRA rollover, funds from existing tax-advantaged accounts can be rolled over into a new IRA tax-free. You can even roll over funds from multiple retirement accounts into a single self-directed IRA, making it easier for you to consolidate and manage your retirement savings.

With a gold IRA rollover, investors can minimize their tax exposure since distributions are normally subject to ordinary income tax rates. Particularly for those in lower-income tax brackets, that can result in gold held in an IRA being taxed at a lower rate than if it were not in an IRA. And for those investors who invest in a Roth gold IRA, they won’t be taxed at all on the gains on their gold investments.

Can You Roll a Traditional IRA Into a Gold IRA?

It is possible to roll Traditional IRA funds into a gold IRA, but there are guidelines to follow when investing in precious metals. These include:

- The gold must have a fineness of .995, or 99.5% purity.

- Gold has to be held by a custodian.

- IRA Contribution Limitsapply (see below)

- Pre-owned gold cannot be added to a gold IRA, but you can open a gold IRA and purchase new gold to add.

Some of these rules are included in Section 408(m)(3) of the Internal Revenue Code, which sets guidelines and exceptions for investing in coins and bullion. Knowing these basic rules may help avoid common pitfalls when you’re preparing for a gold IRA transfer.

What Are the Benefits of a Gold 401(k) Rollover

When you contribute to a gold IRA as part of your retirement portfolio, you’re purchasing actual physical gold as opposed to a gold ETF, which only certifies that you have a vested interest in gold, but not actual ownership. The benefits of investing in gold as part of your IRA include:

- Defense against currency devaluations

- Protection against the effects of inflation

- Less susceptibility to government seizure

- Diversification to help manage investment risks

- Same tax benefits as conventional IRA

What Are IRS Penalties for Retirement Accounts?

The IRS sets forth penalties for not following regulations on different types of retirement savings. The following are a few IRA investing rules to be mindful of so you know how to move a 401(k) to a gold IRA without any penalties:

- If you exceed the contribution limits, you may incur a penalty of 6%. Example: if you exceed the contribution limit by $500, you would be penalized $30 every year until the mistake is corrected

- If you have an IRA, you are not allowed to invest in collectibles, which includes artwork, rugs, antiques, stamps, and other items as defined by IRS Section 408(m)(2). Tax penalties may result. This does not include qualified precious metals.

- Withdrawing any distributions before reaching the age of 59 1/2 incurs a 10% penalty plus income tax. Exceptions include death or disability of the IRA owner, withdrawals to pay certain medical bills, first time home purchases, and higher education expenses. Additionally, the CARES Act allows for early withdrawal in 2020 for up to $100,000 if you are a “qualified individual”: you, a spouse, or dependent are diagnosed with COVID-19, you experience financial difficulties due to job loss, furlough, reduction in hours, or lack of childcare.

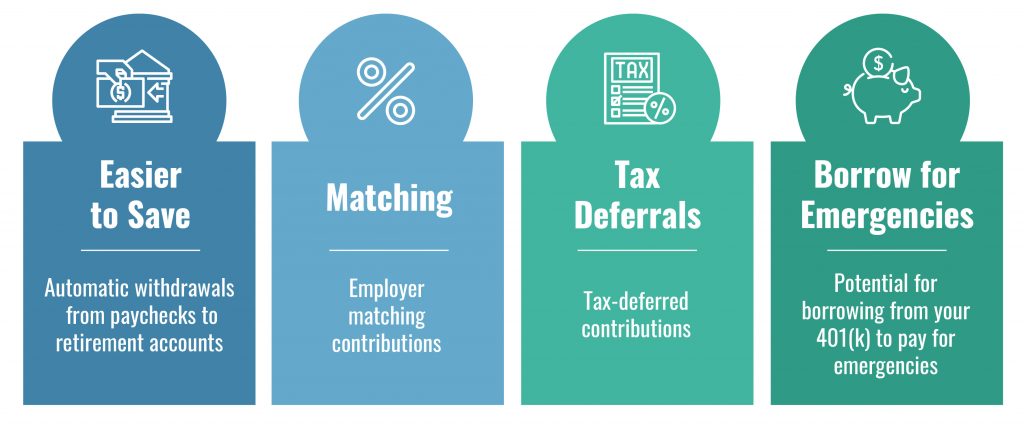

4 Steps for How to Transfer a Conventional IRA Into a Gold IRA

If you’re new to transferring an IRA or rolling over a 401(k), and more specifically, transferring or rolling over into a gold IRA, we’ve put together a simple 4-step process to get you started. Of course, always keep in mind the IRS guidelines for rollovers and distributions to ensure that you are complying with regulations.

- Review investment options, as well as more information about investing in gold and other precious metals, to make sure you’re choosing the best option for your financial goals, and that you are eligible for the specific program you choose.

- Work with your gold IRA specialist to fill out the necessary forms to open your account.

- Partner with your precious metals investment expert to help you transfer a portion of your retirement account into a self-directed IRA. This is an important step to help you avoid IRS penalties.

- Decide which type of metals you want to invest in. After purchase, they will be sent to a secure storage facility.

As you start the process, remember that only IRA-approved gold is eligible. It may be helpful to contact a qualified gold IRA specialist who understands the nuances of self-directed IRAs and how to roll your 401(k) into a gold IRA.

What Are Contribution Limits for an IRA?

Once you’ve established a rollover IRA, you can contribute to it just like with a traditional IRA.

If you establish a rollover IRA and begin making contributions to it, you may inhibit your ability to do a reverse rollover IRA (back to a 401(k)), so evaluate all your options before making any changes.

The IRS has contribution limits for IRAs, which must be followed in order to avoid penalties. The following guidelines will help you understand the contribution limits for gold IRAs:

- As with a traditional IRA, you’re limited to $6,000 in contributions per year ($7,000 if you’re over 50).

- Contributions are across all IRAs, so if you have multiple IRA accounts, you are limited to that $6,000 total across all your accounts.

- Contributions are per person, not per account, so you can potentially contribute to multiple IRAs in the same year.

- If you are over 50 years old, you are allowed to make additional contributions to a 401(k). The catch-up contribution limit for 2020 is $6,500.

Get Started With Your Gold IRA Rollover

Many investors ask if they can roll over a 401(k) into a gold IRA without penalty–and it’s a worthwhile question to ask to protect your investments. The best way to conduct a gold IRA transfer is to work with precious metals investing experts.

By simply filling out our contact form, we’ll connect you with a qualified gold IRA expert who can answer your questions, offer valuable reference materials, help you fill out forms, and choose the best precious metals for your account. We’re ready to help you facilitate the diversification of your retirement portfolio so you can feel more in control of your financial future.

Continue reading Chapter 5 to learn more about how a self-directed IRA works and how you can set up your self-directed gold IRA.

Beginner’s Guide

to a Gold IRA

Table of Contents

Chapter 1: Beginner’s Guide to a Gold IRA: Is a Gold IRA a Smart Investment Choice?

Chapter 2: Gold IRA Rules to Know Before Investing

Chapter 3: Tips for Diversifying Your Retirement Portfolio With Gold

Chapter 4: How to Move Your 401(k) to Gold Without Penalty

Chapter 5: How a Self-Directed Gold IRA Works

Chapter 6: Diversifying Your Portfolio: How to Start a Precious Metals IRA

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.