Beginner’s Guide to a Gold IRA

If you are looking to invest in gold, this Gold IRA Guide will walk you through everything from the reasons why gold is a solid investment to the step-by-step process of setting up your own gold IRA.

Beginner’s Guide to a Gold IRA

If you are looking to invest in gold, this Gold IRA Guide will walk you through everything from the reasons why gold is a solid investment to the step-by-step process of setting up your own gold IRA.

Why Should You Invest in Gold?

Everyone wants their retirement portfolios to perform, but there’s always the risk of huge losses. Successful investors are wise to protect their portfolios with smart investments and diversification, safeguarding their valuable retirement funds with more than just stocks and bonds.

One way to do that is by investing in gold and other precious metals. Gold and silver have given investors security for centuries, and their value today continues to rise. With the same advantages as traditional IRAs, gold IRAs help investors protect their retirement from volatile markets.

Some of the primary reasons to consider adding physical gold to your portfolio include:

Portfolio Diversification

Investors can diversify their portfolios with a variety of assets like stocks and bonds, mutual funds, and ETFs. But they can also invest in gold and other precious metals through a precious metals IRA.

Because there is a consistent demand for gold, investors flock to physical assets during uncertain financial times, which causes the price of gold to fluctuate inversely to the stock market. Make sure you’re building a well-diversified portfolio that gives you the stability you need.

Hedge Against Volatile Markets

We’re living in unprecedented times, which can cause market volatility that affects your investments and retirement. But a volatile market doesn’t mean you have to give up investing and protecting your assets.

In fact, by investing in gold or performing a 401(k) rollover, you may be able to avoid the ups and downs that come with a fluctuating market.

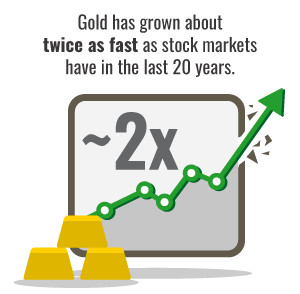

Gold Holds Its Value

Gold is a solid choice as evidenced by the way investors flock to it, particularly in times of economic uncertainty, when it often outperforms other investments. If you’re looking for a long-term investing strategy that will protect your assets from the unknowns, consider investing in a gold IRA.

Learn About the Advantages of a Gold IRA

If you’ve been considering gold as an investment, we know there’s a lot to learn. From the numerous benefits, to the rules for investing in gold, our Gold IRA Guide is a one-stop resource to get the information you need to start making smart investments in precious metals. Read chapters 1-3 to learn more about the basics of gold IRAs and everything you need to know before getting started.

Chapter 1

Is a Gold or Silver IRA a Smart Choice for My Investment?

Chapter 2

Gold IRA Rules to Know Before Investing

Chapter 3

Tips for Diversifying Your Retirement Portfolio with Gold

How to Invest in Gold for Retirement

If you’ve been struggling to find a safe way to invest for retirement, a precious metals IRA could be the answer. No matter how many years until retirement, it’s never too late to start planning and investing.

Traditionally, IRAs have been a safety net for people without access to employer-sponsored plans, like a 401(k). And by investing in a gold through a precious metals IRA, you get the same tax advantages as a traditional IRA, but with the added security of owning physical gold. And getting started is simple and straightforward with the right support.

Set Up a Gold IRA

Opening a gold IRA may seem daunting, but it’s actually quite simple, especially with the assistance of precious metals experts. Not all IRAs permit you to add precious metals to your portfolio, so to begin investing in gold, you’ll need to set up a self-directed IRA. While the process is not difficult, it’s important to make sure you follow IRS regulations to avoid violations and penalties. With these simple steps, you’ll be well on your way to starting your very own gold IRA.

Rollover 401(k) Assets

Gold IRA rollovers can offer tax advantages just like other types of retirement accounts, and it’s even possible to rollover your 401(k) into a gold IRA. But before you do so, make sure to follow guidelines regarding IRA-approved gold, IRS regulations, and contribution and distribution limits.

Learn How to Set Up a Gold IRA

Are you ready to take control of your retirement and start your very own gold IRA? ThrustGold is here to help with our Gold IRA Guide. Chapters 4-6 focus on specific aspects of investing in gold with a gold IRA to give you the necessary tools to help you secure your wealth and invest for retirement

Chapter 4

How to Move 401(k) to Gold Without Penalty

Chapter 5

How a Self-Directed Gold IRA Works

Chapter 6

How to Start a Precious Metals IRA and How to Choose Your Investments

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.

Ready to Protect Your Retirement Savings?

Get our FREE Precious Metals Guide

With this guide, you’ll learn everything there is to know about investing in gold and silver with a precious metals IRA. Whether you’re a long-time precious metals investor or a first-time buyer, our FREE guide will explain the advantages of precious metals IRAs, how to get started investing in precious metals, and how long the IRA process will take.

Request your FREE guide today and learn how you can harness the power of gold and silver to protect your retirement savings.